USDA projects Saudi imports of ready to cook weight of broiler will be 790,000 tonnes in 2017. Saudi Arabia is the third largest importer after Japan and Mexico.

Australian trade in red meat is displayed in below graphic. Carcase mutton is the largest component of the trade following by offal and beef. Australian chilled lamb exports exceed frozen lamb exports to Saudi Arabia and chilled beef exports from Australia are about half frozen beef exports.

The USA was re-admitted to supply Saudi Arabia with beef in July 2016 after being banned for 4 years. Below graphic is FAO OECD projection of Saudi Arabia production by meat type:

FAO is projecting a higher level of poultry imports than USDA and a steady increase going forward. Sheep meat imports are forecast at 125,000 tonnes carcase weight in 2017, with beef imports 185,000 tonnes.

Saudi Arabia imported around 15,000 tonnes of goat meat according to UN Comtrade figures in 2015 with a value of US$79 million.

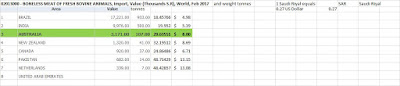

Saudi Customs and Statistics figures for February 2017 showed imports of chilled beef from Australia of 107 tonnes. The graphic below shows Brazil is the largest chilled beef supplier.

our preliminary work indicates no USA chilled or frozen beef was imported by Saudi Arabia in February 2017.

Frozen imports of beef are again headed by Brazil.

India was the second largest supplier of frozen bovine meat in February 2017 and priced at similar levels to import values of Australian frozen beef. Brazilian frozen beef import tonnage was 2,148 tonnes at a unit value of US$3.75 kg. Australia was third in line behind India and Pakistan in imports of fresh chilled lamb carcases into Saudi Arabia in February. Ethiopia was 4th ahead of New Zealand. Australia was the largest supplier of fresh bone in sheep meat in February out of only two suppliers, with New Zealand a way back. Australia supplied almost double that of New Zealand in terms of frozen sheep meat carcases.

New Zealand was the largest supplier by value in bone in frozen sheep meat cuts in February 2017.